My husband and I are having a debate: pay down the mortgage or invest?

When we met, I owned a townhouse. He owned a townhouse. Instead of having a wedding, we eloped in Cancun and used the wedding money to purchase a house together.

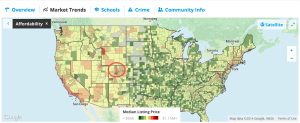

At the time, we could have sold both townhouses. But because we could not recover the cost, we decided to rent them out. The landscape has changed drastically in two years. We are experiencing record high’s in Denver housing prices due to low inventory. It is a seller’s market. If you look at Trulia’s affordability index, the front range is starting to look a lot like LA.

On the other hand, the rental market has its own rally. The Colorado statewide average rent hit an all-time high of $1,026 in 2014. Vacancy rates remain below 5%.

New construction may help to create some vacancies. You may have noticed most of the new builds in suburban areas around Denver are condominiums, and even the stand-alone houses are in very tight patio home communities. However, new builds also tend to be luxury homes at a premium price. Yes, construction is a great sign that the economy is coming back which is bringing jobs – and prospects for those jobs – to Colorado from other places, and it is in turn increasing demand for housing. Low inventory and high prices is creating a housing market “crunch.”

Goals

Keeping the townhouses is a no-brainer for us. Investment diversity for the long-term future, a project on the side, a fail-safe if the marriage falls apart…

One thing that you’ll learn about me while following this blog is that I am a deliberator – it is a strength of mine. Being a deliberator means that rather than deny the risk, I throw it out there, which drives my husband nuts. However, we have a game plan for all possible foreseeable risks, thereby reducing them. This comes in handy when developing business plans, as well as real estate investing.

The transition into real estate investing and property management came naturally for me. My Grandpa has always had rental units. Summer jobs were always cleaning and painting Grandpa’s apartments.

Now I have my stakes on the table, too. How to handle the cash flow – now that we’ve met the first milestone of building an emergency reserve – a critical debate inside of any venture or entity. It is the underlying question in every business.

Investment properties are not only a question of cash-flow but of tax policy and investment strategy. For instance, paying down the mortgage creates cash flow, but your mortgage interest will reduce your taxes. Paying down the mortgage also reduces the gross overall amount that you pay on the house, but what if you can invest for a higher return than your interest paid?

In the next series of blog entries, I am going to illustrate the immediate forecast for each strategy through the lens of paying down the mortgage, or not.

The answer throughout, of course, is how much risk are you willing to take? I want to see numbers before I make that decision, and I will show you what I find.

Be First to Comment