I grew up in property management. Even still, I cringe at the idea of bad tenants and bad investments.

I do not want to lose my ass.

I made a commitment to you to share everything I have learned as I research my real estate investments. Many people, like me, dive into real estate investing with mixed results because we did not fully develop a strategy and had so many conflicting messages about how to measure success.

While at Colorado State University, I developed a property management business plan for my capstone thesis. My final presentation was in front of five venture capitalists who appreciated my approach. That business is becoming wildly successful for the company I consulted while I earned a grade. However, my education did not truly start until I found my first tenants.

Believe me, my first tenants gave me a crash course on property management.

The first part of your business plan is to know your market.

In an earlier post I touched on the Denver Market “crunch” that we are experiencing. I had wanted to downsize my house, without downgrading, and I am especially feeling the crunch. Given that interest rate has increased, given closing costs, given capital gains tax (a future post), I really don’t come out ahead. Plus, everything that I’ve been able to look at is not the quality I’d like in my downsize.

The second part of your business plan is to…

Know Your Value Proposition:

I was asked so many questions from my first tenants that I learned tons about my role and how to talk them through these issues without making their issues my issues.

As the questions kept rolling in, I had flashbacks to my experience as a Trust Advisor educating clients on legal guidelines as it pertains to their situation; explaining rules with your client’s interest in mind given that those documents were likely written and signed long before your client’s needs were in the picture.

Part of my legacy and a huge reason I call this blog “Sharing the Legacy,” are the business lessons I learned from my grandpa. My grandpa always helped his tenants out and in return, most tenants were good to my grandpa and his properties.

This idea drives me in my approach to every business and career venture I undertake.

The third part of your business plan is to…

Know Your Investment

In the last post, we covered three of the four main sources of income from owning this investment property.

1) Cash Flow

2) Depreciation

3) Amortization

Now, we’ve come to

4) Appreciation and capital gains. Capital gains will get its own post soon.

You can take a deeper look at appreciation and your investment by looking at leverage.

Leverage

When you take a loan to purchase the property, the loan is collateralized with the asset and will give you a better interest rate. In addition, your investment is leveraged.

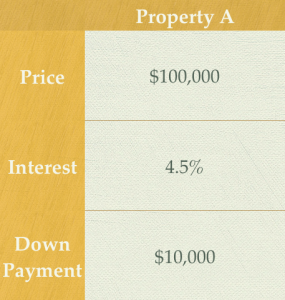

What does leverage mean? Well, this gets fun. I tried to explain it to my husband, and his eyes glazed over. I totally lost him. However, I did not draw a picture, so I am going to attempt to explain it to you but with visuals. Let’s say you purchased your property for $100,000. You put 10%, or $10,000 down payment and obtained a loan with a fixed interest rate of 4.5% for 30 years. You have now paid $10,000 for control of a $100,000 asset.

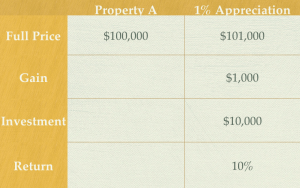

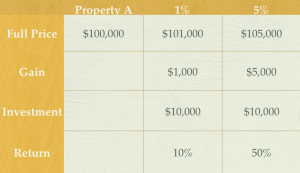

Now, your property has appreciated by 1%. You have a gain of $1,000 on your $10,000 investment which is a 10% return. I told you this gets fun.

Say your property appreciates by 5%. You’ve now gained $5,000 value on your $10,000 investment. A 50% return – very fun!

The one major caveat – if you personally pay the loan each month, then your returns diminish. However, real estate investing is a long-term plan, and it is feasible to ride out the remainder of your mortgage terms with a renter paying the mortgage.

Leverage is one reason not to pay down the mortgage. This method is not a cash flow generator. If you only earn an extra $50 per month, that is still a positive cash flow! The benefit is from the tax shelter it creates (you will not deduct your principal payment but you will deduct many of your other expenses, including interest expense), and from the potential increase in capital.

Now there was a time in the not so distant past where there were three guarantees in life: death, taxes, and appreciation. We watched that bubble burst. We all felt the impact of it. And now we are all wearier to rest our hats on the idea that real estate will always increase in value.

Sad, but true.

Sad but, oh, so true.

In upcoming posts, I’m going to cover criteria you must check – often – to determine if your investment is working for you or if you need to sell. One of the biggest lessons entrepreneurs learn is how to let go and walk away when it simply isn’t working anymore.

I’m also getting the question my husband debates me on: so you have an extra $100 each month, now what!?!?!?

Be First to Comment