My husband and I are new landlords. We each owned townhouses before we met, married, and moved to the other side of Denver. At the time, his townhouse was underwater, and he could not sell it for what it was worth, so he put it up for rent. My townhouse was a short sale at the time of purchase, but because I had purchased more recently, I could not have sold it with any ROI after considering all-in costs.

While residence duration increases with age, on average, people move every two to five years. So the probability is that you will lose money on your purchase. That, there, is my first gripe about purchasing real estate to live in, yourself. Extreme markets aside, it is usually not a good idea..

Why? There is a term in the finance world, “real estate rich, cash poor.” This means that things change, and we need a level of liquidity to be able to adjust. We get married; we get divorced. We have kids; we die. We change jobs. We adopt puppies. Putting all of your savings into a house is not an investment, it is not a retirement plan, and it certainly does not put food on the table when you’ve exhausted your income sources.

Unless, of course, that real estate is generating cash flow for you.

Getting Started

Purchasing real estate is one of the most complicated purchases you will ever make. Make sure you are working with a realtor and a lender who know their craft and focus on educating you through the process. If you plan on investing in real estate, add a CPA, attorney, and experienced property manager to your speed dial list.

Some things you will be able to do on your own as a new landlord and these two resources helped me tremendously.

For Rent – Generating interest for rent is easier than putting a sign on your doorstep. Try Zillow to list for free.

Background Checks – TransUnion has created a rental application, credit check and background check called My Smart Move.

Cash Flow

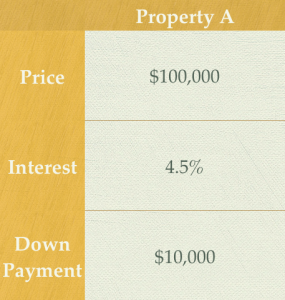

Let’s say you purchase an investment property. The price is $100,000. You pay $10,000 as down payment and obtain a 30 year fixed loan for 4.5% for the remaining $90,000. Heads up, I am going to use this assumption throughout my property management series.

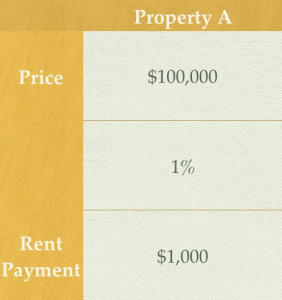

General rule of thumb is that rent price is 1% of your purchase price. One percent of $100,000 is $1,000.

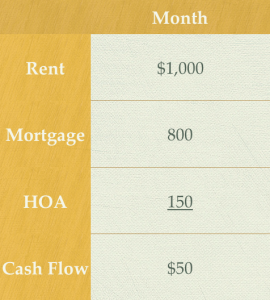

You get a tenant – great! You are earning $1,000 per month – even better! Cash flow is simple to measure. Rent comes in, and payments go out, what is left over is cash in your pocket. All this tells you, however, is whether or not you have positive cash flow – your number one metric when you evaluate your investment.

If, in the following month, you have to fix a broken furnace for $200, your cash flow may be a negative $150 for the month. As a side, you can not tap into the security deposit if you have added expenses. The security deposit is not yours, and you are merely holding it in case the tenants default on their lease. You will want to build up an emergency fund to carry you if you have emergency repairs or vacancies, and if you are not there yet, you’ll have to tap into your savings.

Positive cash flow is your number one metric when you evaluate your investment. However, if you dig a little deeper, you can use this analysis to optimize your investment and plan for anything that comes up – like, repairs and vacancies.

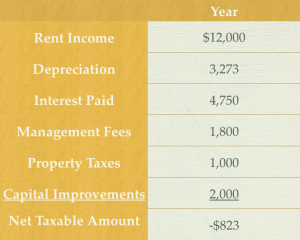

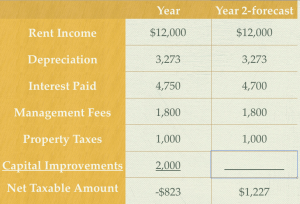

Tax Statement

Your Taxes are calculated from your operating income on your Income Statement. You will start with your rent income for the year, $1,000 * 12. You will deduct your interest paid, management fee, and property taxes – these are considered operating expenses. You will subtract any capital improvements you make to the property as well as repairs and supplies.

What’s the difference between repairs and capital improvements? For example, if you paint the walls or fix a toilet, this is considered repairs and supplies and is deducted as an expense. If, for instance, you purchase new windows for $2,000, this is a capital improvement because it increases the value and the life of the property. You can depreciate capital improvements.

Last, depreciation. You are allowed to deduct depreciation expense on your investment property. Land is not considered a depreciable asset since land does not wear out, so you will subtract the value of the land from the purchase price. I am assuming that 10% of the value of the property is for land and I will depreciate the value of the property, $90,000, on a straight-line basis for 27.5 years since it is a residential property.

Once you have taken all of your deductions, your Net Taxable Amount is the amount from which you will calculate your taxes due. A loss on your net taxable amount is a good thing! No taxes are due! You will want to be in the red, but as close to zero as possible since there is no additional benefit below zero.

Because every line item on this income statement is somewhat predictable, I also use it to plan my budget for capital improvements and repairs. Based on Year 1, I know that I will have roughly $1,250 to spend in order to maximize my tax benefit.

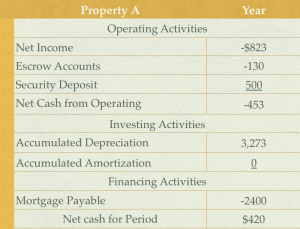

Statement of Cash Flow

When making decisions on things as whether to hire out property management or replace a piece of crap sliding glass door, you will also want a deeper look at your cash flow. The Statement of Cash Flow breaks down your activities into Operating, Investing and Financing activities for the period (month, quarter, year).

For example, your mortgage payment may be further broken down into principal, interest, and escrow accounts. Interest, tax, and PMI escrows are considered operating costs. These are the costs of doing business. The principal payment, on the other hand, is a financing activity as it is paying down the loan you took out to purchase the asset.

My Statement of Cash Flow looks like this. It tells me I have a positive cash flow – number 1 metric. I also have a negative net income, so I have optimized my tax benefit creating additional cash flow. Also, my mortgage has been paid down. By this analysis, I know that I have hit three of the four primary sources of income from owning this investment property. 1) Cash Flow, 2) Depreciation, 3) Amortization (mortgage principal is paid down). The last – and, I will tackle this topic in my next post – is 4) Appreciation and capital gains.

With a few extra dollars in my pocket from my investment properties, I now have a foundation for my argument with my husband whether to pay down the mortgage or invest. Because I know where my cash flow is going, and I can plan and prepare for my expenses. However, there is still work to be done. Also, I will share it with you.

Be First to Comment